Introduction

Banking fraud costs banks and customers billions every year. Moreover, criminals use new and clever tricks. As a result, banks need better tools to fight back. Fortunately, AI offers a strong solution. First, AI can spot fraud in real time. Next, it cuts down false alarms. Therefore, banks save money and protect customers more effectively.

Why Banking Fraud Detection Matters

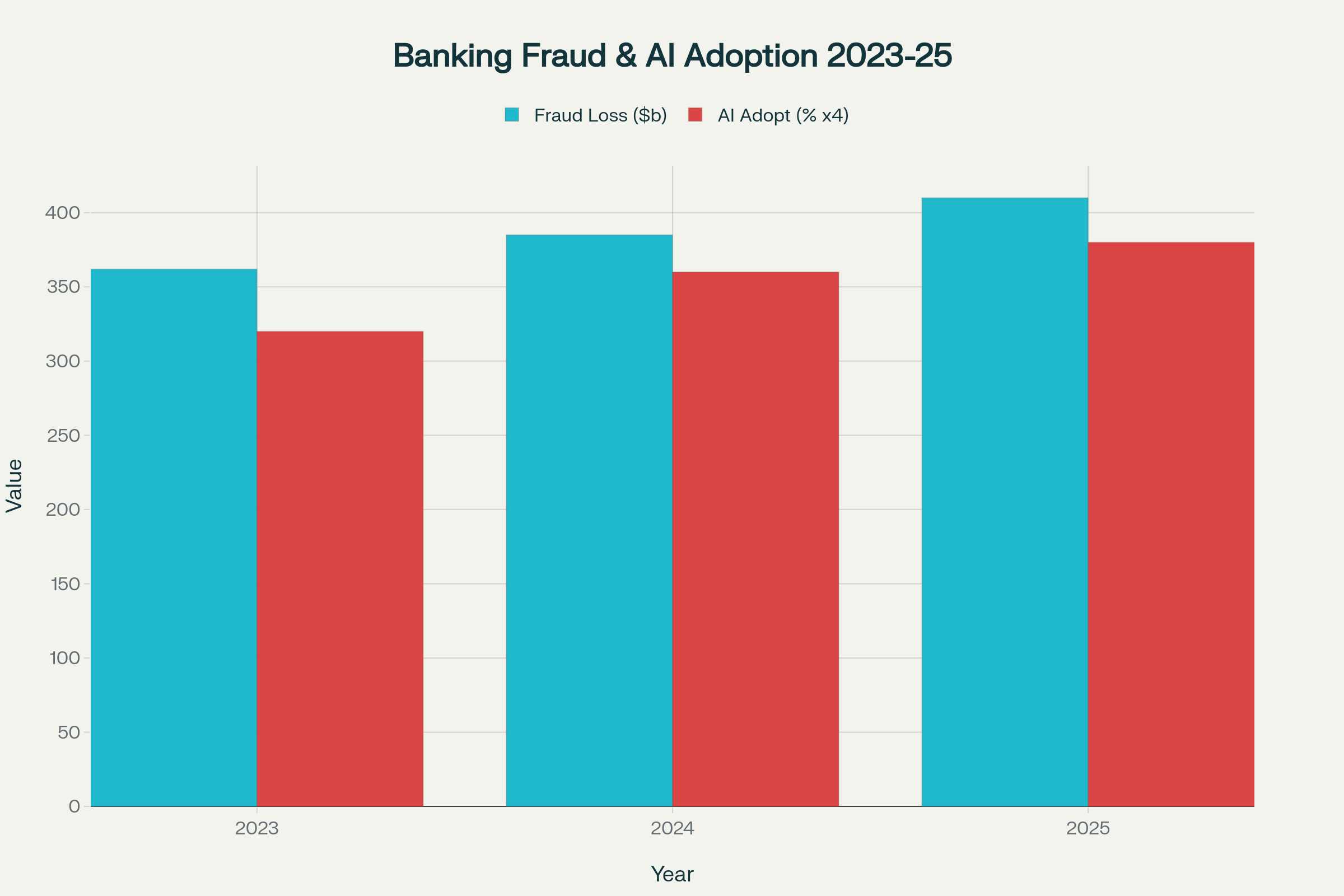

First, let’s review the scale of the problem. In 2025, global fraud losses reached $410 billion. Additionally, fraud methods keep evolving. Consequently, old systems struggle to keep up. However, AI adapts quickly. Moreover, AI learns new patterns continuously. As a result, banks can tackle advanced fraud schemes.

Banking fraud losses continue rising despite increased AI adoption in financial institutions from 2023-2025

Banking Fraud Statistics

| Year | Global Fraud Losses (Billion USD) | AI Adoption in Banking (%) |

|---|---|---|

| 2023 | $362 | 80% |

| 2024 | $385 | 90% |

| 2025 | $410 | 95% |

Source: IBM, Feedzai

How AI Changes Fraud Detection

Real-Time Monitoring

First, AI watches each transaction as it happens. Then, it checks the details against normal behavior. For example, it compares a purchase’s location to your typical spending area. If something seems odd, AI flags it right away. Consequently, banks can block fraud instantly.

Moreover, AI processes millions of transactions every second. Therefore, it scales better than human teams. Meanwhile, analysts focus on the most complex cases. As a result, banks improve response times significantly.

Fraud detection in banking using AI technology illustrated by a robotic hand securing a digital lock youverify

Pattern Recognition

Furthermore, AI excels at finding hidden patterns. It links accounts, devices, and transaction flows. For instance, multiple accounts using the same device trigger an alert. Consequently, banks uncover organized fraud rings.

Next, AI models learn from each flagged case. Thus, accuracy improves over time. Additionally, AI adapts to emerging fraud tactics. As a result, banks stay one step ahead of criminals.

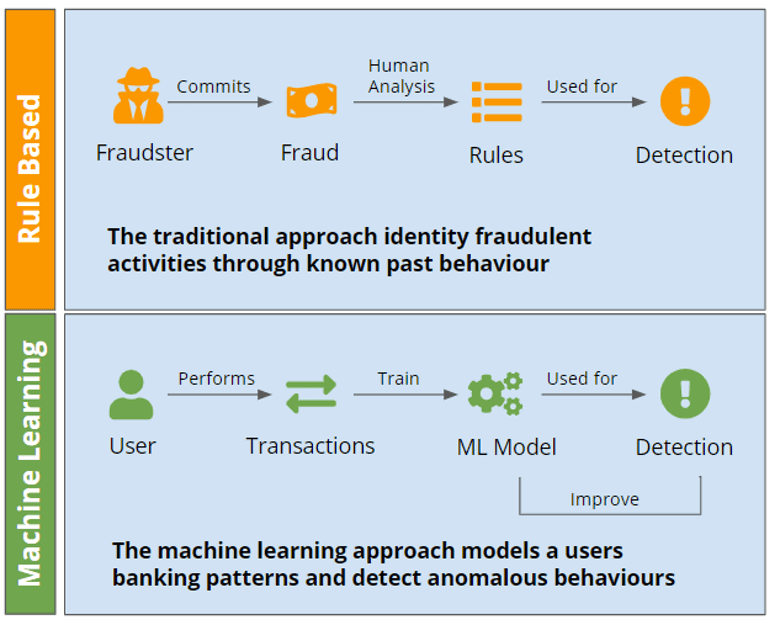

Comparing traditional rule-based fraud detection with machine learning models for improved detection in banking sdk

Types of Banking Fraud AI Can Detect

First, credit card fraud remains a top challenge. AI spots unusual purchase amounts and locations. Next, identity theft is another major risk. AI compares new account applications with historical data. If something mismatches, AI raises an alert.

Moreover, AI prevents account takeover attempts. It checks login patterns and device identifiers. Consequently, unauthorized access prompts extra verification.

Also, AI fights money laundering. It tracks fund movements across multiple accounts. When money flows look suspicious, AI flags the activity.

AI Fraud Detection Benefits

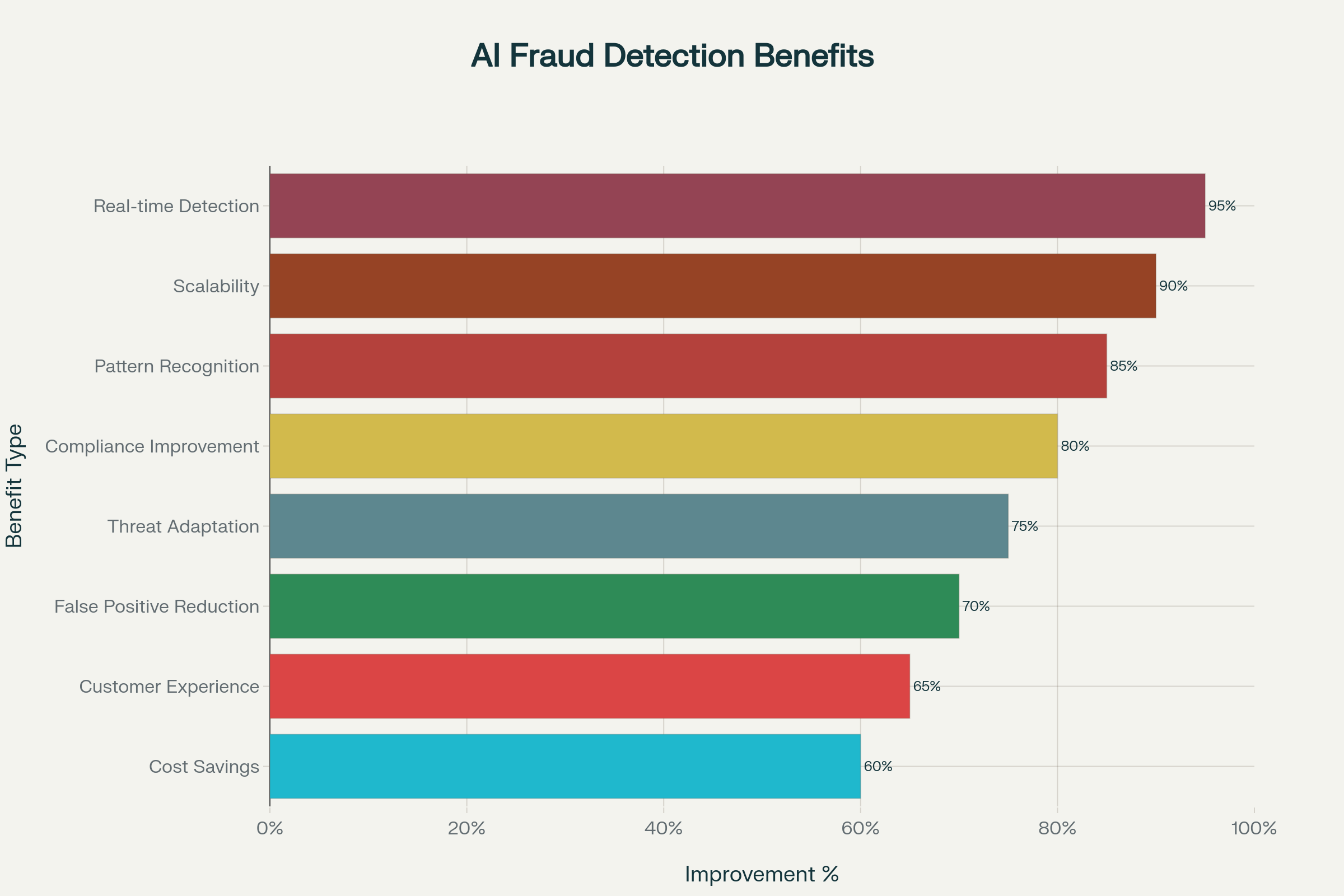

AI brings many gains to fraud detection. First, it delivers real-time alerts. Next, it cuts false positives by up to 70%.

Key benefits of AI in fraud detection ranked by improvement percentage achieved

Furthermore, it scales seamlessly to millions of users. As a result, banks save on manual review costs.

Key Benefits of AI in Banking Fraud Detection

| Benefit | Improvement (%) | Impact Score (1–10) |

|---|---|---|

| Real-time Detection | 95% | 9.5 |

| Scalability | 90% | 9.2 |

| Pattern Recognition | 85% | 9.0 |

| Compliance Improvement | 80% | 8.8 |

| Threat Adaptation | 75% | 8.2 |

| False Positive Reduction | 70% | 8.5 |

| Customer Experience | 65% | 7.5 |

| Cost Savings | 60% | 8.0 |

Source: Banking AI Implementation Studies

Moreover, AI frees staff from routine work. Therefore, analysts focus on strategic tasks. As a result, banks boost overall efficiency.

How AI Fraud Detection Works

Machine Learning Models

First, AI builds models that learn from past data. Then, it uses these models to score new transactions. If a score is high, AI flags the transaction as risky. Consequently, banks can block fraud faster.

Next, AI updates its models with new data daily. As a result, detection accuracy keeps improving.

Behavioral Analysis

Moreover, AI studies user behavior patterns. It learns when and how customers usually transact. If behavior changes suddenly, AI investigates.

As a result, AI can detect fraud even when fraudsters use correct credentials.

Real-Time Scoring

Furthermore, AI assigns a risk score to every transaction. Low scores mean safe transactions. High scores mean possible fraud. Then, banks decide on the next action.

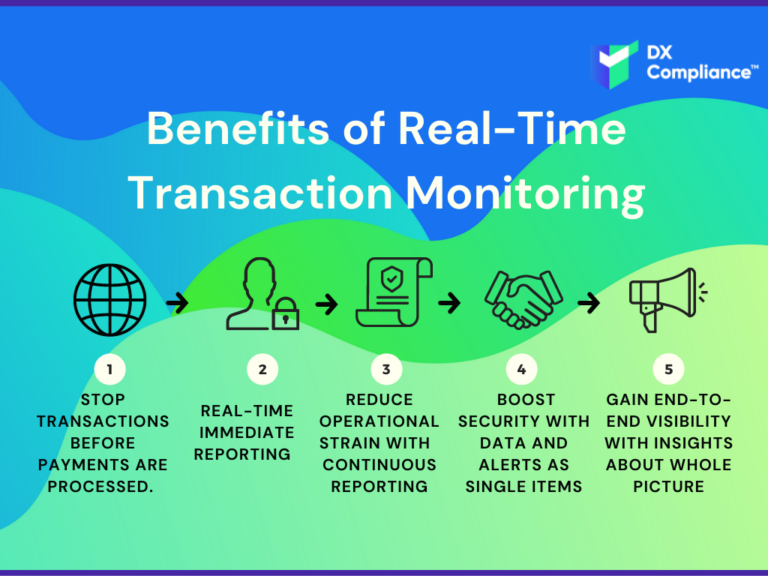

Benefits of real-time transaction monitoring in banking include stopping fraudulent transactions early, real-time reporting, reduced operational strain, enhanced security, and comprehensive visibility with actionable insights dxcompliance

Types of Fraud AI Detects Best

| Fraud Type | Detection Accuracy (%) | Annual Losses (Million USD) |

|---|---|---|

| Synthetic Identity | 95% | $6,000 |

| Credit Card Fraud | 92% | $24,000 |

| Money Laundering | 90% | $32,000 |

| Identity Theft | 88% | $16,000 |

| Phishing Scams | 87% | $4,500 |

| Account Takeover | 85% | $12,000 |

| Wire Fraud | 82% | $8,000 |

| Check Fraud | 75% | $21,000 |

Source: Financial Crime Prevention Reports

The Technology Behind AI Fraud Detection

Natural Language Processing

AI reads emails and chat logs to spot phishing. For example, it identifies fake requests for bank details. Consequently, it prevents social engineering scams.

Deep Learning Networks

Furthermore, deep learning models detect complex fraud patterns. As a result, banks catch fraud that other systems miss.

Anomaly Detection

Moreover, anomaly detection flags data points that stand out. Therefore, banks spot new fraud strategies quickly.

Challenges and Solutions

Data Quality

AI needs clean data to work well. Therefore, banks must ensure data accuracy and completeness.

False Positives

Sometimes AI raises false alarms. However, banks can tune AI models to lower these rates. As a result, customer inconvenience drops.

Privacy Concerns

AI analyzes lots of personal data. Consequently, banks must secure this data with encryption and strict access controls.

System hacked warning on a digital interface illustrating cybersecurity risks in banking sqnbankingsystems

ROI of AI Fraud Detection Implementation

| Year | Implementation Cost (Million USD) | Fraud Savings (Million USD) | Net ROI (%) |

|---|---|---|---|

| 1 | $5.0 | $8.0 | 60% |

| 2 | $2.0 | $15.0 | 650% |

| 3 | $1.5 | $22.0 | 1,367% |

| 4 | $1.0 | $28.0 | 2,700% |

| 5 | $0.8 | $35.0 | 4,275% |

Source: Banking AI ROI Studies

Moreover, banks recover their costs quickly. Therefore, AI fraud detection offers strong returns.

Future of AI in Banking Fraud Detection

Predictive Analytics

First, AI will predict fraud before it happens. For instance, it might spot planning patterns via data analysis.

Collaborative Intelligence

Next, banks will share fraud insights through AI networks. Consequently, new threats get flagged instantly.

Biometric Integration

Moreover, AI will combine with biometrics. It will use voice, face, and behavior data. As a result, fraud detection becomes even more accurate.

Best Practices for Banks

Start Small

First, banks should pilot AI on credit card fraud. Then, they can expand to other areas.

Invest in Training

Furthermore, staff need training on AI tools. As a result, they can trust and use AI effectively.

Monitor Performance

Also, banks must track AI performance continuously. Therefore, they can fine-tune models for better results.

Stay Updated

Finally, AI technology evolves fast. Consequently, banks must update systems regularly.

Getting Started with AI Fraud Detection

Choose the Right Partner

First, work with AI vendors experienced in banking. Consequently, implementation goes smoothly.

Plan Implementation

Next, define goals and timelines clearly. Also, decide which fraud types to address first.

Test Thoroughly

Moreover, use historical data for thorough testing. Therefore, banks can evaluate AI performance before going live.

Conclusion

AI is transforming banking fraud detection. It offers real-time monitoring, pattern recognition, and cost savings. Moreover, it adapts to new fraud tactics automatically. While challenges exist, banks that adopt AI will protect customers better. Therefore, start your AI fraud detection journey today.

Want to learn more? Visit MyUndoAI for the latest AI insights in banking and finance.