Introduction

Tax professionals spend an average of 40 hours per client on manual data entry, document review, and compliance checks. That's time that could go toward strategy and client relationships. AI automation tools are changing this. They handle document scanning, data classification, error detection, and even preliminary tax calculations. This guide explores which tools actually work, how they integrate into your workflow, and what to watch out for.

Featured Snippet

AI tax automation tools use machine learning to scan documents, extract data, classify information, and flag compliance issues automatically. They range from specialized tax software (like CCH and Thomson Reuters solutions) to general automation platforms (like Zapier and Make) that can be configured for tax work. Most reduce manual data entry by 60-80% and catch errors rule-based systems miss. The tradeoff: they require initial setup and ongoing monitoring to prevent hallucinations or misclassifications.

Table of Contents

- What Tax Automation Actually Means

- How AI Automation Works in Tax Practice

- Types of Tax Tasks AI Can Automate

- Leading AI Tools for Tax Automation

- Comparing Tools: Features and Pricing

- Implementation Strategy: Getting Started

- Real Limitations and Where Automation Fails

- FAQ

What Tax Automation Actually Means

Tax automation doesn't mean the computer files your returns. It means the computer handles the repetitive, manual parts so you handle the strategic parts.

Specifically, automation addresses three categories of work. First, data entry. When a client sends a stack of receipts, bank statements, and invoices, someone has to categorize them, extract amounts, and input them into software. AI can scan documents, recognize receipt types, extract dollar amounts, and pre-populate forms. A human still verifies the results.

Second, compliance checking. Tax codes change. Rules layer on top of each other. A client making $150,000 with a home office and rental property income has multiple compliance requirements. Manual systems miss edge cases. AI systems flag deviations from standard patterns, raising questions before filings go out.

Third, error detection. AI catches inconsistencies humans miss after eight hours of data entry. A client reported $50,000 in business income last year but this year it's $8,000 with no explanation. A deduction is 3x higher than the previous five years. These flags don't mean errors occurred, but they warrant investigation.

Automation augments human judgment rather than replacing it. Tax work still requires understanding client circumstances, recognizing legitimate deductions, and navigating edge cases where the rules aren't clear.

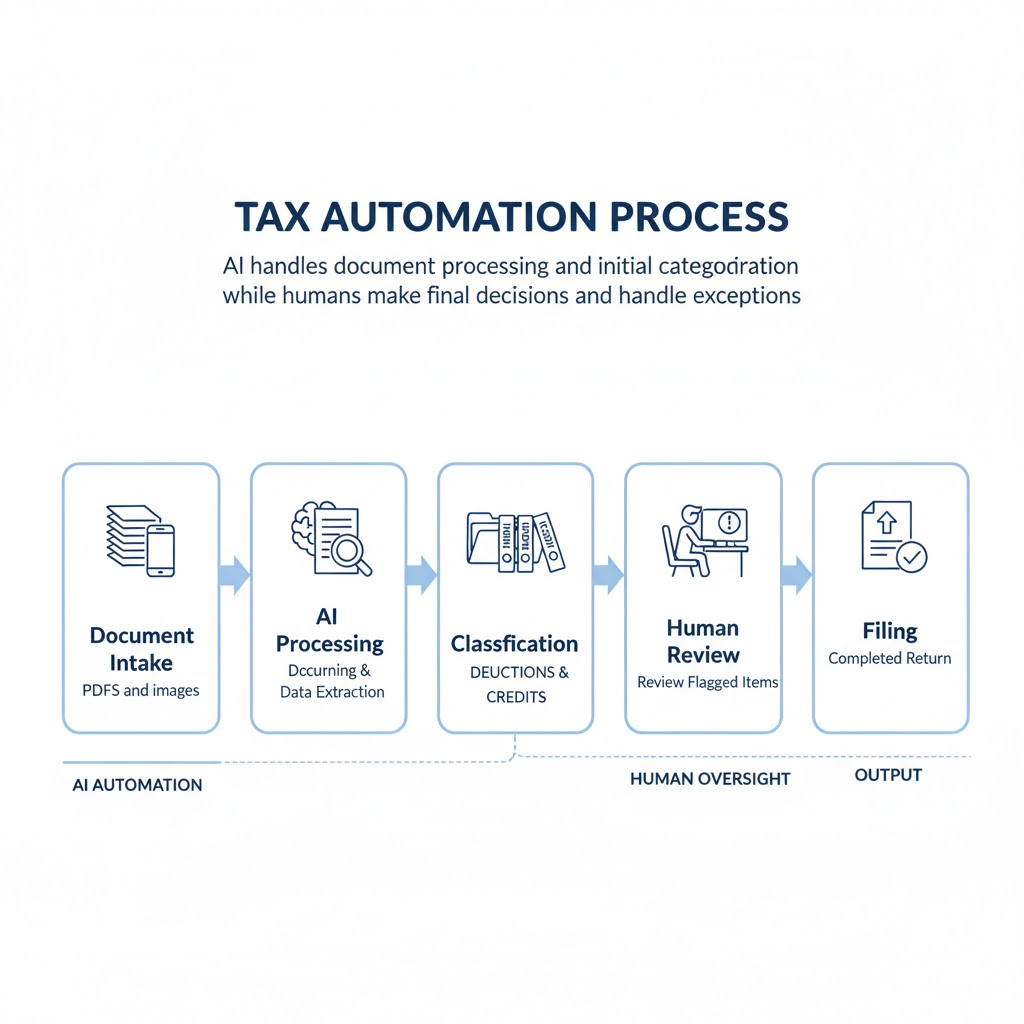

How AI Automation Works in Tax Practice

Tax automation works through document processing, data extraction, and pattern matching. When a receipt image enters the system, the software first converts it to readable text using optical character recognition (OCR). Modern OCR powered by neural networks achieves 95%+ accuracy on standard documents.

The system then classifies the document. Is this an invoice, receipt, or bank statement? Machine learning models trained on thousands of tax documents recognize patterns. A receipt from Office Depot with line items for folders and printer paper is a business supply expense. A receipt from a medical clinic is a deductible medical expense. These classifications happen automatically, though unusual items get flagged for review.

Next, the system extracts relevant data: dollar amounts, dates, vendor names, payment methods. It standardizes the data, handles different date formats and currency variations, and enters information into templates.

Finally, the system flags anomalies. Does this deduction fit the client's tax profile? Is the amount reasonable compared to prior years? Did the client claim conflicting deductions? These flags appear in a review dashboard where a human tax professional investigates.

Humans make the final decisions. The system makes the process faster and catches obvious errors.

Types of Tax Tasks AI Can Automate

Not all tax work automates equally. Some tasks are perfect for AI. Others require human judgment that automation can't replicate.

Tasks That Automate Well:

Document classification and data extraction work because patterns are consistent. A W-2 always has an employee's income in the same location. Business expense receipts have standard formats. AI learns these patterns and processes them reliably.

Bookkeeping transactions automate well too. Credit card statements, bank transactions, and expense reports follow predictable formats. AI categorizes transactions, matches receipts to transactions, and flags duplicates or mismatches.

Compliance flagging works because rules-based. If income exceeds $200,000 and the client took a home office deduction, specific requirements apply. AI checks these conditions and surfaces relevant rules.

Preliminary calculations automate well. Standard deductions, child tax credits, and estimated tax payments follow formulas. The system applies the rules and generates preliminary numbers.

Tasks That Resist Automation:

Judgment calls don't automate. A client spent $3,000 improving their home. Is it a deductible repair or a non-deductible improvement? The answer depends on specifics an AI system can't assess. A human has to ask questions, understand the situation, and make the call.

Unusual circumstances resist automation. A client had a business loss, received an inheritance, and exercised stock options all in the same year. How these interact for tax purposes isn't a straightforward rule. A tax professional has to analyze the situation.

Fraud detection paradoxically resists automation. While AI can flag statistical anomalies, deciding whether an anomaly represents fraud or legitimate complexity requires human judgment. A client with a very high charitable deduction could be generous, could be overstating, or could be following a legitimate gifting strategy. An AI system can't distinguish without more context.

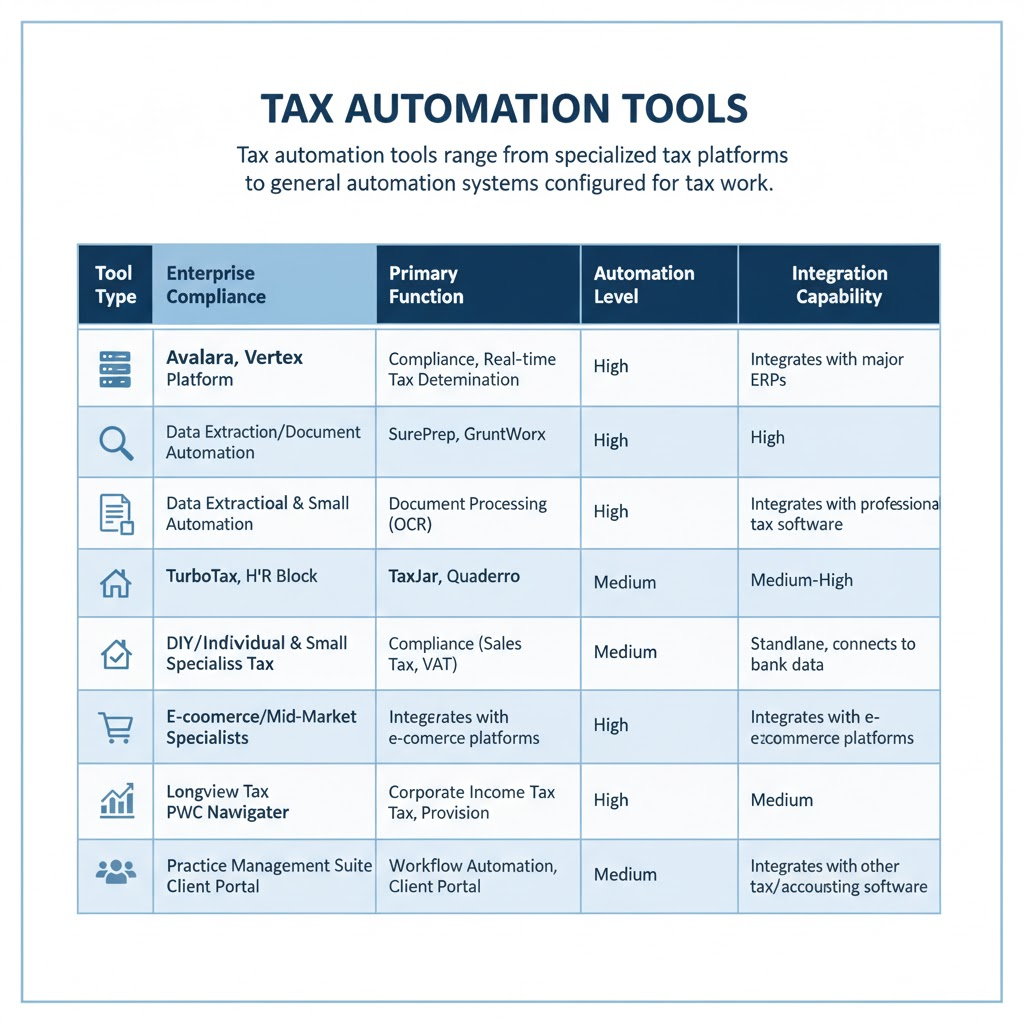

Leading AI Tools for Tax Automation

Specialized Tax Automation Platforms

Thomson Reuters ONESOURCE

Thomson Reuters built ONESOURCE specifically for tax departments and firms. It automates document collection, data extraction, compliance reviews, and reporting. The system connects to accounting software, maintains audit trails, and handles multi-jurisdictional complexity.

Automation level: High. The system handles most routine processing with minimal human intervention. Pricing is enterprise-only, typically $50,000+ annually. Setup requires substantial configuration and training.

The limitation: cost and complexity make it impractical for solo practitioners or small firms.

CCH Axcess

CCH Axcess provides cloud-based tax preparation with automation features. It integrates with common accounting platforms, automates client intake workflows, and flags compliance issues. The system processes documents and pre-populates returns.

Automation level: Medium-High. It automates standard workflows but still requires substantial human review for complex returns. Pricing starts around $3,000-5,000 annually depending on firm size and modules.

The limitation: automation benefits plateau for complex tax situations.

Intuit ProConnect

Intuit's ProConnect offers document imaging, client intake automation, and compliance checking. It integrates with Intuit's tax software ecosystem and handles routine processing.

Automation level: Medium. Handles document management and standard workflows. Pricing ranges from $2,000-4,000 annually. Setup is faster than enterprise solutions.

The limitation: less sophisticated than specialized platforms. Automation is more workflow management than AI-powered intelligence.

General Automation Platforms (Configured for Tax)

Zapier + Custom AI Models

Zapier connects tools and automates workflows. Paired with AI document processing APIs (like Amazon Textract or Google Document AI), it can automate tax-specific workflows. Accountants build custom automations: scan a receipt, extract data, categorize it, and add it to a spreadsheet or accounting software.

Automation level: Medium. Depends on the custom configuration. Pricing is flexible, starting at $20-30 monthly for basic automation, scaling with complexity.

The advantage: highly customizable and affordable for small firms. The disadvantage: requires technical setup knowledge or an integration specialist.

Make (formerly Integromat)

Similar to Zapier, Make connects tools and automates workflows. Tax firms use it to automate document routing, data extraction, and client notifications.

Automation level: Medium. Comparable to Zapier. Pricing is similar: $10-50+ monthly depending on complexity.

The advantage: visual workflow builder is user-friendly. The disadvantage: less specialized for tax than dedicated platforms.

Comparing Tools: Features and Pricing

| Tool | Automation Level | Document Processing | Compliance Flagging | Pricing | Setup Time |

|---|---|---|---|---|---|

| Thomson Reuters ONESOURCE | High | Advanced OCR + extraction | Yes, extensive | $50,000+ annually | 8-12 weeks |

| CCH Axcess | Medium-High | Good OCR + extraction | Yes, standard | $3,000-5,000 annually | 2-4 weeks |

| Intuit ProConnect | Medium | Good OCR + extraction | Yes, basic | $2,000-4,000 annually | 1-2 weeks |

| Zapier + AI APIs | Medium | Dependent on API | Customizable | $20-100+ monthly | 1-2 weeks |

| Make | Medium | Dependent on connected apps | Customizable | $10-50+ monthly | 1-2 weeks |

What the data shows:

Enterprise platforms (Thomson Reuters, CCH) offer the most sophistication and automation but cost substantially more and require longer implementation. Mid-market platforms (Intuit ProConnect) balance features and cost. DIY platforms (Zapier, Make) offer affordability and flexibility but require more technical work.

For a solo practitioner or small firm handling 20-50 clients annually, Intuit ProConnect or Zapier makes sense. For a 10-person firm handling 200+ returns, CCH Axcess becomes justifiable. Thomson Reuters suits only large firms with complex multi-jurisdictional requirements.

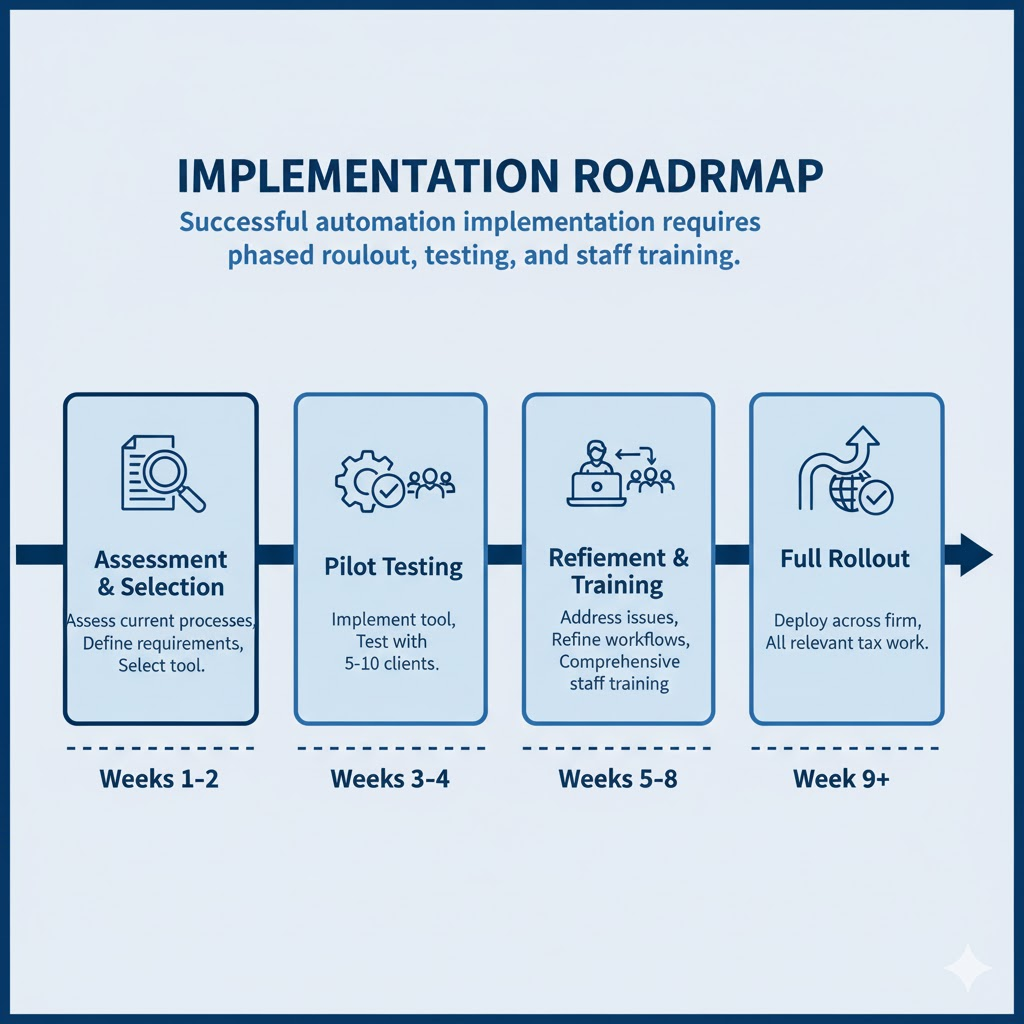

Implementation Strategy: Getting Started

Most tax firms fail at automation because they try to implement too fast. A better approach is phased implementation.

Week 1-2: Assessment and Selection

Audit your current workflow. Which tasks consume the most time? Document intake takes 40% of hours? Compliance checking takes 25%? Data entry takes 20%? Target the highest-impact task first.

Evaluate tools based on your specific needs. If 80% of your clients are small business owners with basic bookkeeping, Intuit ProConnect probably suffices. If you handle multi-state returns and complex entities, CCH Axcess becomes more justified.

Week 3-4: Pilot Testing

Don't automate 100 clients immediately. Select 5-10 clients with straightforward returns and run them through the automated workflow. Document what works and what requires manual intervention.

Week 5-8: Refinement and Training

Based on pilot results, adjust your processes. Train staff on the new workflow. Identify which document types the system handles well and which need human pre-processing.

Week 9+: Full Rollout

Expand automation to your full client base. Monitor for errors and unexpected issues. Refine further based on real-world performance.

The common mistake: skipping the pilot phase and implementing too broadly too fast, which leads to errors and staff resistance.

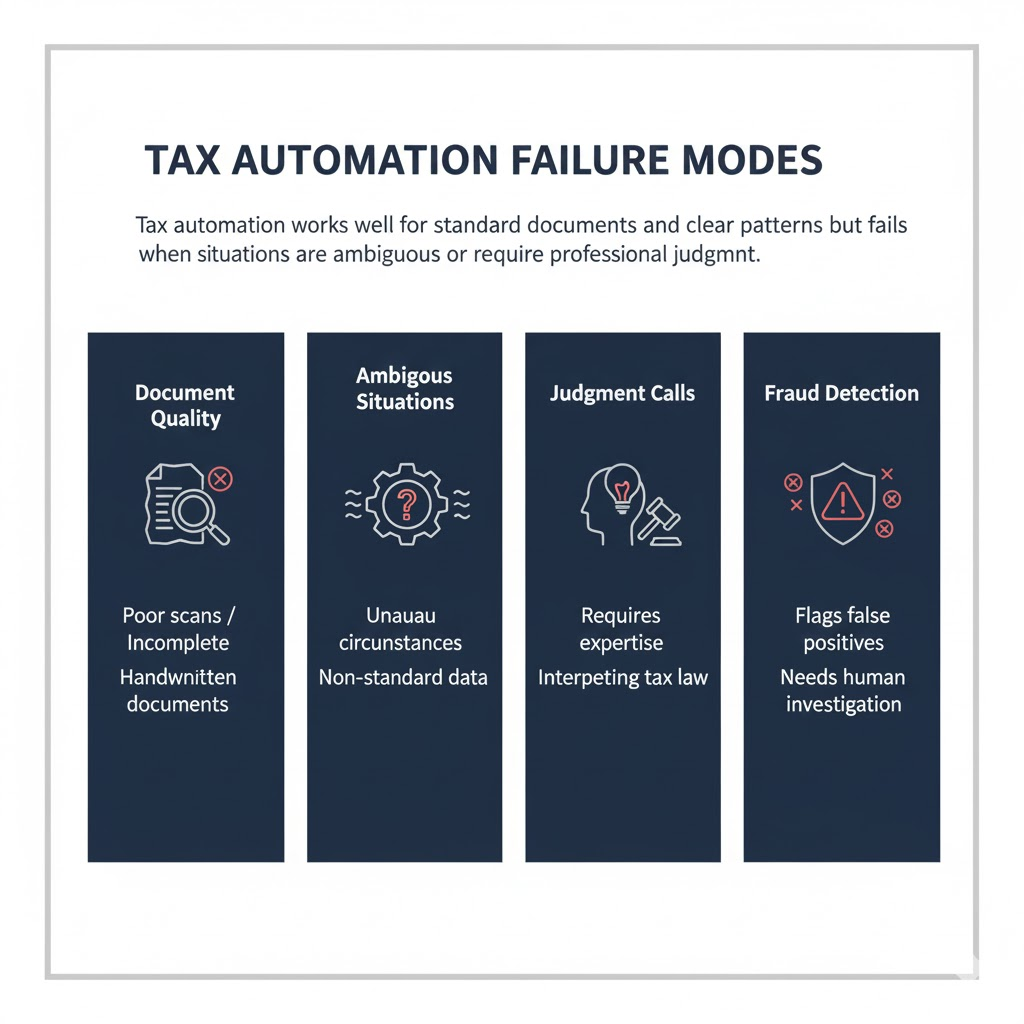

Real Limitations and Where Automation Fails

AI tax automation sounds perfect until you encounter the edge cases where it falls apart.

Poor Document Quality

The system assumes clear, legible documents. A faded receipt from 10 years ago, a handwritten invoice, or a photocopy of a photocopy defeats OCR. The system misreads amounts or fails to extract data entirely. A human has to manually enter the data anyway, defeating the purpose of automation.

Ambiguous Classifications

A client spent $500 at an office supply store. The automated system categorizes it as a business deduction. But the receipt shows they also bought personal items (notebooks for their kids, personal files). Proper classification requires knowing what was actually purchased for business versus personal use. The automation system can't ask clarifying questions.

Hallucination and Overconfidence

AI systems sometimes generate plausible-sounding but false information. An extraction system might confidently report a dollar amount that's not on the document, having filled in a blank based on statistical patterns. A human reading the document carefully would catch this, but a busy accountant skimming automation results might miss it.

Unusual Circumstances

A client had a business loss, received an inheritance, and exercised stock options in the same year. The interaction of these items for tax purposes isn't a standard rule. An automation system trained on typical returns will flag this as anomalous but can't analyze the tax implications properly. A human professional has to step in.

Fraud Detection False Positives

A client took a home office deduction of $12,000. Based on historical data, the automation system flags this as unusually high and raises a red flag for potential fraud. In reality, the client legitimately expanded their home office this year. The system creates busywork for the professional to investigate a false alarm.

Regulatory Changes

Tax rules change annually. Automation systems trained on 2024 rules may misapply 2025 rules until they're updated. A tax professional has to track changes and adjust the system. Automation doesn't eliminate the need to stay current with tax law.

The reality: automation handles the 80% of work that's routine and predictable. The 20% that's unusual, ambiguous, or requires judgment still falls to humans.

The Future of Tax Automation

Tax automation is advancing in specific directions.

Improved Document Processing

OCR accuracy continues to improve. Future systems will handle poor-quality documents, handwritten notes, and unusual formats better. But this remains a work in progress.

Multilingual Support

As businesses become more global, systems that process documents in multiple languages become valuable. Current systems are improving here but aren't perfect yet.

Predictive Compliance

Instead of just flagging after-the-fact issues, future systems will predict tax implications before transactions happen. A client considering a large charitable donation? The system models the tax impact. They're thinking about timing an expense? The system shows the tax consequences.

Real-Time Tax Optimization

Systems could continuously monitor a client's financial activity and suggest optimization strategies. Did they exceed estimated tax thresholds? The system recommends action before penalties apply.

Integration with Accounting Software

Currently, tax automation and accounting automation are separate. Future integration means seamless data flow from transaction recording through tax filing, reducing manual reconciliation entirely.

None of this eliminates the need for tax professionals. Instead, it shifts their time from data entry toward strategy, client relationship, and judgment-based work.

FAQ

Q: Will AI automation eliminate tax professional jobs?

A: No. Automation eliminates tedious data entry, not professional judgment. Tax professionals who learn to use automation effectively become more valuable because they handle more clients with less administrative overhead. Professionals who ignore automation will struggle as competitors become more efficient.

Q: How long does it take to implement tax automation?

A: Simple tools like Intuit ProConnect take 1-2 weeks to set up for basic workflows. Mid-range platforms like CCH Axcess take 2-4 weeks. Enterprise platforms require 8-12 weeks or more. Most firms see ROI within 6-12 months through time savings.

Q: Can I use general automation tools like Zapier instead of specialized tax software?

A: Yes, if you're willing to do custom setup work. General tools cost less and offer flexibility. But you lose specialized tax knowledge built into purpose-built platforms. For solo practitioners, Zapier can work. For larger firms, specialized platforms offer better value.

Q: What's the biggest mistake firms make implementing automation?

A: Implementing too fast without a pilot phase. Firms automate 100 clients immediately, errors accumulate, staff resist the change, and they abandon automation. Phased implementation with pilot testing prevents this.

Q: How do I know if a document failed to process correctly?

A: Good automation systems flag confidence levels. If the system extracted a dollar amount from a document but had only 70% confidence, it flags that for human review. Without visible confidence indicators, you need to spot-check results regularly.

Q: Will automation reduce errors in tax returns?

A: Yes, but not to zero. Automation catches errors from manual data entry and flags logical inconsistencies. But it introduces new error types (hallucinations, misclassifications). Overall, properly implemented automation reduces errors, but doesn't eliminate them.

Q: Can I automate complex, multi-state returns?

A: Partially. Complex returns have many unusual elements that resist full automation. Automation handles document processing, standard deductions, and compliance flagging. The professional still makes decisions on complex issues.

Additional Resources

For a comprehensive directory of tax automation tools, visit TaxProExchange's AI Tools directory. They maintain an updated list of specialized and general tools used by tax professionals, with user reviews and implementation guides.

For foundational understanding of how machine learning powers these systems, see our guide on AI vs Machine Learning vs Deep Learning Made Easy.

Sources

CCH. "CCH Axcess Tax Automation Features." CCH Documentation. Accessed November 2025.

Intuit. "ProConnect Tax Preparation Software." Intuit Professional. Accessed November 2025.

Thomson Reuters. "ONESOURCE Tax Automation Platform." Thomson Reuters. Accessed November 2025.

Amazon Web Services. "Textract Document Processing." AWS Documentation. Accessed November 2025.

Zapier. "Workflow Automation and Integration." Zapier Blog. Accessed November 2025.

National Society of Accountants. "Technology and Automation in Tax Practices 2024." NSA Research. Accessed November 2025.